Crête Fortunois:

Your Fast Track to Smarter Investing With Crête Fortunois

Sign up now

Sign up now

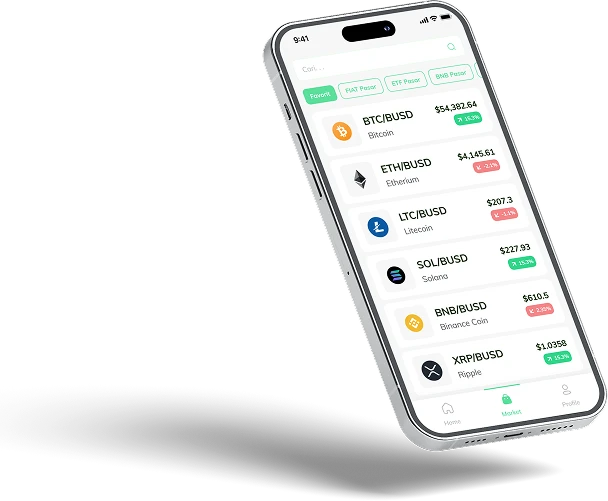

Crête Fortunois acts like a signpost for anyone exploring investment education. Many want to understand markets but feel lost among conflicting advice. It doesn’t teach or make choices, it simply points learners toward independent education firms, providing clarity in a world where information often seems scattered or overwhelming.

The site’s key role is connection. Once registered, users share basic contact info, letting firms communicate their learning resources and methods directly. No rankings, filtering, or recommendations are applied. Each learner evaluates what aligns with their goals, ensuring personal choice remains central.

This setup ensures accountability stays clear. Firms provide knowledge, learners judge relevance, and Crête Fortunois facilitates contact without bias. By remaining neutral, it avoids hype and pressure, creating a calm, structured environment where individuals can explore investment education safely and confidently.

Investment education provides insight into market dynamics, examining trends, past disruptions, and recurring reactions to major shifts. By understanding why these movements happen, learners gain perspective without being guided on what actions to take next.

Education supports informed awareness by providing context. Markets respond quickly to news, data, and investor emotions. Learning develops the ability to pause, analyze trends, and ask better questions. It does not eliminate uncertainty but helps individuals interpret movements thoughtfully, creating a more measured approach to investment decisions.

The limits of education are clear. It does not remove risk or forecast results. Global events, political changes, and liquidity shifts continue to drive markets. Materials vary in depth. Learners must evaluate content critically. Education shows recurring patterns but does not offer a roadmap. It illuminates possibilities without guaranteeing future moves.

Picture Crête Fortunois as a calm harbor while market waves crash around it. Questions arrive from curious learners, and educators notice interest signals, but no lessons are served on the site itself. Like a bustling railway station, trains pull in, passengers decide where to go, and order prevails amid movement. The system fosters exploration without pressure.

Getting started begins with registration. It’s quick, simple, and only collects what’s needed: a name for identification, an email for messages, and a phone for follow ups. No lessons appear. No advice is delivered. The aim is clear, connect curious individuals with educational firms in a calm, structured way without adding unnecessary steps.

Providing accurate details matters. Educators respond more smoothly when the information is complete. Rushing this step can create confusion later, especially in fast markets where decisions are time sensitive. Taking time now avoids regrets, making later conversations more meaningful and ensuring the context of your learning is clear and actionable.

Registration does not unlock content, recommend providers, or offer guidance. Its sole purpose is to open communication. From there, learners decide what to explore, research, and ask. Consulting qualified financial professionals helps place insights into context. Markets, including crypto, move quickly, so registration opens a door while choices and responsibility remain fully yours.

Markets are noisy. Prices jump, headlines scream, and emotions spike. Investment education slows the moment, showing why movements unfold in stages rather than in straight lines. By noticing recurring patterns, learners understand behavior instead of chasing predictions. Education clarifies what happens, not what will happen next.

Learning adds perspective. Small swings make sense within larger cycles, and panic fades when events are viewed in context. Calm thinking reduces shock without eliminating risk. Independent research and advice from financial professionals help learners apply lessons to real world situations, building awareness gradually and avoiding hasty reactions.

Behavior repeats because human emotions repeat. Fear, hope, greed, and relief shape price trends. Education highlights emotional cycles instead of attempting to predict outcomes. Understanding why patterns recur matters more than guessing what comes next, helping learners stay focused when markets feel overwhelming and reducing reactive decision making.

Structure organizes information. Headlines alone mislead; context connects events over time. Patterns replace panic, clarity replaces noise. Education improves understanding by showing how pieces fit together, allowing learners to see the bigger picture without relying on predictions or guarantees, keeping perspective steady in volatile markets.

A single headline doesn’t tell the whole story; context gives it meaning. Education shows how events link together over time instead of standing alone. Small changes can create ripples that appear later, and fear travels faster than calm. Structure helps replace knee jerk reactions with patterns, turning chaos into clarity. Learners see how pieces fit without expecting guaranteed outcomes, improving understanding step by step.

Markets rarely move in straight lines, they unfold in phases. Investment education helps link scattered ideas: growth builds, momentum slows, and imbalances appear repeatedly, even when headlines scream or whisper. By connecting these dots, learners start seeing the bigger picture without guessing outcomes or chasing predictions.

Subtle early signals often seem boring at first: low trading activity, narrow price ranges, quiet markets. These quiet periods are easy to ignore, yet they often hint at shifts to come. Education teaches learners to pay attention to the whispers before the loud moves, turning seemingly small details into meaningful insight for smarter, more patient decisions.

Studying patterns over time gives perspective. A minor dip stops feeling dramatic when seen in a larger cycle. Education sharpens observation, shapes better questions, and supports independent research. Conversations with qualified financial professionals help learners apply these lessons in real world decisions, turning knowledge into grounded understanding without relying on predictions.

Crête Fortunois works like an organized hub connecting people after registration. Requests follow a clear path, nothing jumps ahead. Like an airport tower keeping flights orderly, it doesn’t control the planes but ensures smooth traffic.

Information moves in multiple directions while structure stays calm, giving users a predictable and low pressure experience as they explore educational connections.

A layered system keeps communication aligned. Signals reach educators correctly, notifications arrive without distortion, and interest moves predictably. During busy periods, structure matters more than speed. Even simple guides can prevent confusion when paths bend unexpectedly. This approach keeps interactions readable and expectations grounded, so everyone knows where they stand.

Flowing structure enhances market understanding. Quick moves attract attention, but broader trends provide clarity. Crête Fortunois allows conversations to unfold at a steady pace, letting learners decide when to engage and when to pause. Calm, measured processes encourage observation over reaction, helping participants understand patterns rather than chase short term movements.

By staying focused on connection, the system avoids unnecessary noise. Markets move in phases: accumulation, slowdown, and imbalance. Quiet early signals, low volume, narrow ranges, often precede bigger shifts. Observing these patterns over time places small changes in context. Crête Fortunois does not predict outcomes but improves questions, observation, and overall understanding of market behavior.

Extended structure supports awareness over time. Separating access from education keeps interactions clear and low pressure. Questions grow sharper, independent research adds perspective, and comparing ideas maintains balance. Talking with qualified professionals helps learners place insights into context. Awareness expands when structure holds, noise drops, and information flows predictably.

Investment education explains ideas, it doesn’t deliver results. Learning doesn’t guarantee success, accuracy, or favorable outcomes. Markets move for many reasons: breaking news, policy shifts, or sudden surprises. Education provides context, helping learners interpret movements without pretending to control or predict what happens next.

Awareness improves through study, not certainty. Two learners can review the same material and see it differently. Education sharpens observation, helps ask better questions, and improves understanding, but it cannot remove surprises. Markets remain unpredictable, and no amount of learning can create a crystal ball.

Conversations focus on concepts, patterns, and past behavior rather than outcomes. They do not remove risk or control markets. Personal decisions, combined with external forces, determine results. Volatile markets, including cryptocurrency, involve risk, and losses may occur. Education guides understanding but never guarantees performance or safety.

Understanding markets often begins with behavior, not just numbers. Early shifts appear in sentiment and positioning before prices fully react. Education helps learners see how momentum builds, slows, and fades in stages, making patterns clearer without telling anyone what actions to take.

Crête Fortunois supports this process by connecting individuals with independent educators. People explore common market phases through these connections without receiving advice or instructions on decisions. The site simply facilitates learning conversations, keeping access clear, structure stable, and focus on understanding rather than outcomes.

Registration enables that connection. A full name, email, and phone number let educators respond directly. No educational material is shown during registration. Its purpose is singular: allow contact so learning discussions can begin. From this simple step, individuals gain the space to explore ideas, ask questions, and start building awareness about market behavior safely.

What learning does is adjust reactions. It slows rushed choices, frames risk, and surfaces hidden assumptions when prices swing quickly. Knowledge gives space to think, helping learners respond thoughtfully instead of acting impulsively when volatility strikes.

Real world experience shows its impact. Education cannot stop losses or predict market moves, but it reduces knee jerk responses. Knowledge helps pause before reacting to fear, hype, or sudden swings. Education rarely delivers wins, but it prevents unforced mistakes, guiding learners toward steadier, more measured decisions even when conditions feel unpredictable.

Investment education shows how understanding builds over time. It explains how capital flows, sentiment, and policy shifts interact repeatedly, shaping cycles. Education highlights patterns, not outcomes. Markets expand, compress, and reset. Learning reshapes expectations, encourages better questions, and supports calmer, more deliberate reactions in a world where uncertainty is always present.

Investment education often starts by sharing information, so careful handling matters. Names, emails, and phone numbers are exchanged, and systems need to prevent misuse or confusion. When managed properly, attention stays on learning instead of worrying about mistakes or privacy, keeping discussions smooth and focused on exploring ideas.

Think of it like locking your door before leaving home. It doesn’t stop every risk, but it reduces exposure and gives peace of mind. Similarly, secure handling of contact details keeps conversations about education flowing without distractions. When learners can focus on ideas instead of concerns, discussions are more productive, calm, and meaningful.

Registration is the toolbox. Contact information, names, emails, and phone numbers, is a key tool to start communication. No instructions or lessons are stored here. Managing this data carefully is like keeping tools organized: prevents mistakes, reduces risk, and keeps focus on learning rather than worrying about privacy or misuse.

Education happens outside the toolbox, in action. Educators share explanations, insights, and examples during direct interactions. The focus is on recognizing patterns, cycles, and market behavior, not predicting outcomes. Learning sharpens observation and questioning, helping participants apply concepts practically while staying aware that knowledge doesn’t guarantee results.

Each conversation uses different tools. Some focus on long term trends, others on quick market behaviors. Independent research and consultation with financial professionals complement the learning toolkit. Cross checking assumptions and comparing perspectives uncovers blind spots. Awareness increases, questions improve, and learners build practical understanding without expecting certainty.

Responsible use of the tools is essential. Sharing only what’s necessary, reading messages carefully, and asking precise questions keeps everything organized. Learners and educators share responsibility for clarity, focus, and outcomes. When the toolbox is handled with care, the learning process becomes structured, safe, and productive without unnecessary distractions or risks.

Understanding grows when attention shifts from single moves to the bigger timeline. Crête Fortunois keeps access smooth while market activity speeds up or slows down, helping learners focus on discussions instead of chasing short term noise. A steady structure gives space to notice patterns and connect ideas without being overwhelmed.

Imagine watching traffic from a bridge instead of at a street crossing. Cars stop and start, but from above, patterns become clear. Distance lets learners spot rhythms, understand sudden changes, and see connections that are invisible up close. Perspective turns chaos into insight, letting observation replace reaction.

Registration opens a simple path for communication. Names, emails, and phone numbers let educators respond directly. Nothing else happens, no lessons, no advice. It’s like leaving a note at a desk so the right person can reply later. The goal is connection, not guidance, keeping the focus on starting conversations safely and clearly.

Education doesn’t remove stress from markets, but it explains why stress exists. Sharp drops spark fear; rapid gains trigger excitement. Awareness helps slow reactions, even when emotions remain strong. Markets feel loudest when clarity feels lowest. Education highlights those moments, helping learners recognize patterns and respond thoughtfully without promising guaranteed calm.

Crête Fortunois stays neutral to keep expectations clear. It connects learners with educators without judging quality or selecting who participates. Like a signpost, it points the way while leaving decisions to the individual. Independent research and professional conversations help balance understanding, giving perspective while responsibility stays personal.

| 🤖 Sign-Up Cost | Registration free of charge |

| 💰 Fee Structure | Completely fee-free |

| 📋 Method of Registration | Simple and expedient signup process |

| 📊 Educational Content | Focuses on Digital Currency, Stock Market, and other Financial Instruments |

| 🌎 Market Coverage | Covers most countries but does not include the USA |